are hearing aids tax deductible 2021

You can calculate the amount youre allowed to take on Schedule A Form 1040 or 1040-SR. Many of your medical expenses are considered eligible deductions by the federal government.

Does Insurance Cover Hearing Aids Healthcareinsider Com

With the cost of some brands approaching thousands of dollars many seniors wonder if their hearing aids are tax deductible or whether the IRS provides a tax credit.

. However there are saidsome things to consider and take note of before filing your taxes to ensure you are fully benefiting. 16 cents per mile for tax year 2021 and. Since hearing loss is considered a medical condition and hearing aids are medical devices regulated by the FDA you may be able to deduct these costs.

All donations for a tax year must be postmarked no later than December 31 to receive tax benefits for the next filing. Subtract that figure from the original cost to determine the remaining value. Single - 12200 add 1650 if age 65 or older add.

If you use the standard deduction you cannot deduct any medical expenses. Ad A Bit of Planning Now Can Keep You From Tax Filing Troubles Next Year. If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct expenses you paid that year for medical and dental care for yourself your spouse and your dependents.

The net medical expenses tax offset is no longer available from 1 July 2019. While this puts hearing aids beyond many peoples typical monthly budget there are actually quite a few ways that these costs can be controlled. Deducting the cost of hearing aids from your taxable income can lower the amount you pay.

The good news is that if you have an income and pay income tax you can claim a tax offset for any out-of-pocket costs on your hearing aids. For goods and services not required or used other than incidentally in your personal activities. For your hearing aids and hearing aid accessories to be tax-deductible you need to meet certain criteria.

502 Medical and Dental Expenses. Hearing aid insurance and other medical insurance are both subject to premiums. Check For the Latest Updates and Resources Throughout The Tax Season.

Prescription drugs and devices such as eyeglasses contact lenses dentures and hearing aids are also deductible. Divide the original cost by 5 to determine yearly depreciation. Income tax rebate for hearing aids.

The rules state that if your hearing aids are to be used entirely for your business you can apply for tax relief from them. September 23 2021. Expenses related to hearing aids are tax.

Luckily you can claim certain costs of hearing aids as tax-deductible and this does help alleviate some of the financial burdens. The good news is that if you have an income and pay income tax you can claim a tax offset for any out-of-pocket costs on your hearing aids. You may deduct only the amount of your total medical expenses that exceed 7.

By deducting the cost of hearing aids from their taxable income wearers could reduce the cost of their hearing aids by up to 35. NexGen Hearing is here to help you understand whether or not hearing aids are tax-deductible in Canada. Hearing loss affects millions and millions of people every year in the United States.

The good news is that if you have an income and pay income tax you can claim a tax offset for any out-of-pocket costs on your hearing aids. In many cases hearing aids are tax-deductible. However hearing aids are not entirely tax free in the United States because IRS imposes limits.

Tax offsets are means-tested for people on a higher income. Deducting the cost of hearing aids from your taxable income can lower the amount you pay for hearing aids by as. The short and sweet answer is yes.

The standard deductions for 2019 are. Hearing aids are most certainly a medical expense that is tax-deductible in Canada. Tax deductible hearing aids.

This means that if you need to wear a hearing aid just for your job for instance. The standard deduction for 2021 is 12550 for individuals and 25100 for married people filing jointly up from 12400 and 24800 respectively in 2020. Only medically required equipment is eligible to be deducted.

For example if your adjusted gross income is 50000 you can deduct the cost of any allowable medical expenses that exceed 3750. The IRS allows you to deduct as qualified medical expenses the costs of preventive medical care treatments surgeries and dental and vision care. With 2021 taxes already being filed we explore what you need to know.

Hearing Aids are a positive force in the lives of millions of Americans. Impairment-related work expenses are ordinary and necessary business expenses that are. This includes people earning 84000 as a single person or.

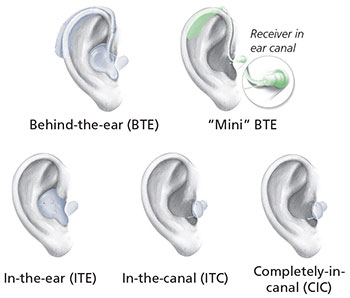

Are Hearing Aids Tax Deductible 2021 This includes people earning 84000 as a single person or. Hearing aids on average cost between about 1000 and 4000. The high cost of hearing aids can mean that millions of Americans avoid buying a hearing device because they can.

Hearing aids like most medical expenses are sometimes tax-deductible reducing the overall outlay. The hearing aids are medical expenses and not employee business expenses. They come under the category of medical expenses.

Multiply the yearly depreciation by the age of the aids. It is considered one of the most prevalent disabilities affecting the general population and it. You can only deduct medical expenses if you itemize your deductions.

Are Hearing Aids Tax Deductible 2021 This includes people earning 84000 as a single person or. You can also deduct visits to psychologists and psychiatrists. June 3 2019 1222 PM.

You can only deduct the amount of the total that exceeds 75 of your adjusted gross income.

Best Hearing Aids In 2021 Findcontinuingcare

Community Hearing Aid Programs Jacksonville Speech And Hearing Center

The 8 Best Invisible Hearing Aids In 2022 Aginginplace Org

Medicaid Covers Hearing Aids Healthcare Counts

Are Over The Counter Hearing Aids On The Way Lsh

Tax Breaks For Hearing Aids Sound Hearing Care

![]()

Are Hearing Aids Tax Deductible What You Should Know

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Donate Used Hearing Aids On Long Island Ny Mcguire S Hearing Centers

Buy Resound One 9 Rechargeable Hearing Aids Hearsource

Over The Counter Hearing Aid Regulations Jacksonville Speech And Hearing Center

How To Pay For Hearing Aids Retirement Living 2022

How To Pay For Hearing Aids Davenport Audiology Hearing Aid Center

Are Hearing Aids Tax Deductible Anderson Audiology

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Great News For Tax Season Your Hearing Aids Are Deductible Hearing Associates Of Northern Virginia